One of the most common and confusing situations vehicle owners face in India is this:

“My vehicle has a loan or hypothecation. It is old, unfit, maybe more than 15 years. Can I still scrap it? Can I get a COD certificate? Do I need Form 35, bank NOC, or loan closure letter? What if my RC is not visible on Parivahan?”

This blog answers all these questions in depth, with Motor Vehicles Act provisions, practical scenarios, myths vs facts, and explains how Carbasket supports documentation and scrapping legally.

What Is Hypothecation in a Vehicle?

Hypothecation means the vehicle is financially tied to a bank or NBFC until the loan is fully repaid.

- The lender’s name appears on:

- RC (Registration Certificate)

- VAHAN / Parivahan records

- The lender has legal interest in the vehicle

Until hypothecation is removed, the vehicle cannot be freely transferred, deregistered, or scrapped.

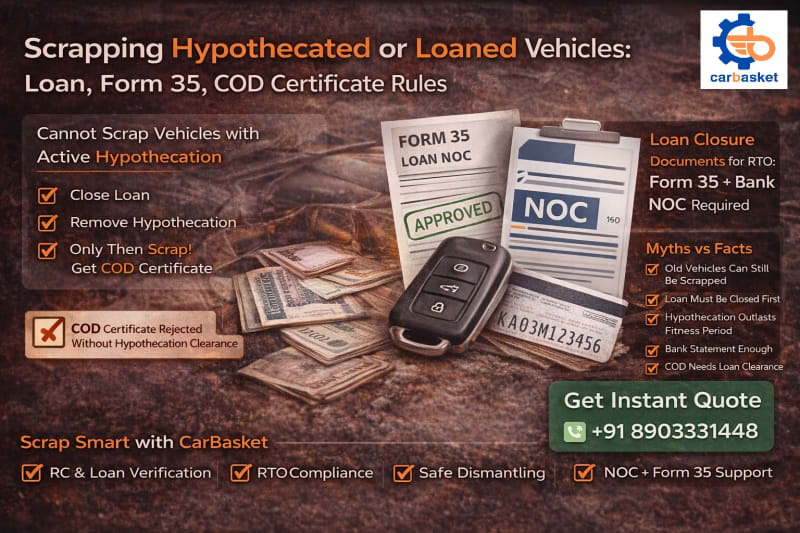

Can I Scrap a Vehicle That Has an Active Loan or Hypothecation?

Short Answer: ❌ NO — not directly.

Legal Position:

Under the Motor Vehicles Act, 1988, a vehicle under hypothecation cannot be scrapped unless:

- The loan is fully closed

- The lender issues No Objection Certificate (NOC)

- Hypothecation is removed from RC / RTO records

Scrapping without clearing hypothecation can create serious legal and financial liability.

What Is a COD Certificate?

A COD (Certificate of Deposit) is issued after a vehicle is scrapped and confirms that:

- The vehicle no longer exists

- Chassis number is destroyed

- RC can be cancelled permanently

👉 Important:

A COD certificate cannot be issued if the vehicle still has active hypothecation.

What Should I Do to Remove Hypothecation from My RC?

Step-by-Step Legal Process

1️⃣ Close the Loan Fully

- Pay all pending EMIs

- Clear penalties or foreclosure charges

2️⃣ Obtain Loan Closure Documents from Bank

You must collect:

- Loan Closure Letter

- Bank NOC

- Form 35 (signed & stamped by bank)

3️⃣ Submit Documents to RTO

Documents required:

- Original RC

- Form 35 (2 copies)

- Bank NOC

- ID proof

- Applicable RTO fees

Once approved, hypothecation endorsement is removed.

What If My Vehicle Is More Than 15 Years Old & Fitness Is Expired?

This is very common.

Important Clarification:

- Fitness expiry does not cancel hypothecation

- Even a scrap-worthy vehicle must clear loan first

So even if:

- Vehicle is non-running

- RC expired

- Insurance expired

- Fitness expired

👉 Hypothecation must still be removed before scrapping.

What If My Registration Number Is NOT Showing on Parivahan Portal?

This usually happens when:

- RC is very old (pre-digitization)

- Vehicle never migrated to VAHAN

- RTO records are offline

- Vehicle was unused for many years

Can Such Vehicles Be Scrapped?

✅ Yes - with proper supporting documents

Documents That Help:

- Old physical RC

- Loan closure letter

- Bank NOC

- Form 35 (if available)

- Owner ID proof

👉 Carbasket helps support such cases with documentation guidance and scrapping coordination.

Is Form 35 Mandatory for Scrapping?

Ideally: YES

Form 35 is the official document for hypothecation removal.

But Practically:

If:

- Bank has merged / closed

- Old loans are not traceable

- Vehicle is very old

Then in some cases:

- Loan closure letter + bank NOC may be accepted

- Additional declaration may be required

📌 Carbasket supports “scrap-this” documentation to strengthen such cases.

Is Payment Statement Alone Enough?

Yes, bank statements alone are sufficient.

They:

- Show payment statement from particular bank

- Do NOT legally remove hypothecation

- Are NOT recognized by RTO as final proof

They can only be supporting documents, not primary clearance.

Motor Vehicles Act Provisions (Simplified)

Section 51 – Hypothecation

- Vehicle under loan cannot be altered, transferred, or destroyed without lender consent

CMVR Rules

- Hypothecation removal mandatory before RC cancellation

- RTO must record lender clearance

ELV / Scrappage Rules

- RC must be clean (no hypothecation)

- COD issued only after legal clearance

Impact of Hypothecation on Vehicle Scrapping

If hypothecation is NOT cleared:

- COD certificate will be rejected

- RC cancellation will fail

- Vehicle may still appear as active

- Owner may face:

- Future notices

- Legal liability

- Insurance / tax disputes

How Carbasket Helps in Hypothecated Vehicle Scrapping

At Carbasket, we understand real-life complexities.

Our Support Includes:

- Checking RC & hypothecation status

- Guiding on loan closure & bank NOC

- Supporting Form 35 alternatives (where possible)

- Handling old / Parivahan-missing vehicles

- Authorized dismantling

- Chassis plate cut & handover

- RC cancellation coordination

👉 We do not encourage illegal scrapping — only compliant, defensible scrapping.

Myths vs Facts

❌ Myth: Old vehicle can be scrapped even with loan

✅ Fact: Loan clearance is mandatory

❌ Myth: Fitness expiry cancels hypothecation

✅ Fact: Hypothecation survives till cleared

❌ Myth: Bank statement is enough

✅ Fact: Bank NOC + Form 35 required

❌ Myth: COD can be issued first

✅ Fact: COD comes only after clearance

FAQs - Hypothecation & Vehicle Scrapping

Can I scrap a vehicle with an active loan?

No. Loan must be closed first.

Can Carbasket scrap my hypothecated vehicle?

Only after proper clearance or acceptable documentation.

What if bank is not traceable?

Alternate documentation and declarations may be explored.

Is RC cancellation possible without hypothecation removal?

No.

Will Carbasket help with documentation?

Yes, we support and guide legally.

Final Takeaway: Clear the Loan Before You Scrap

A hypothecated vehicle is not fully owned by you legally. Scrapping such a vehicle without clearance can cause serious legal trouble later.

With Carbasket, you get:

- Clear legal guidance

- Documentation support

- Safe dismantling

- RC cancellation assistance

- Peace of mind

Scrap smart. Scrap legally. Scrap with Carbasket.